SUI has experienced an impressive price rally, rising nearly 20% in just two days. This surge marks the continuation of a near three-week uptrend fueled by rising interest from SUI enthusiasts.

As the market shows growing optimism, the altcoin has caught the attention of investors, setting the stage for further price movement.

SUI Traders Are Hopeful Of Gains

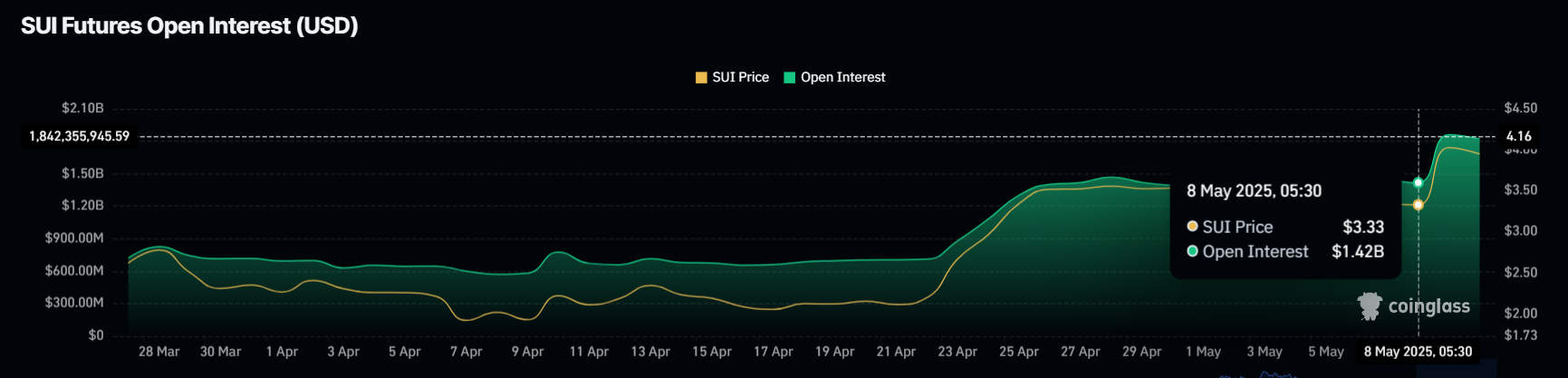

The Open Interest in SUI has surged by 28% in just 48 hours, jumping from $1.42 billion to $1.82 billion. This $400 million increase signals a growing interest in the Futures market, with traders eager to capitalize on the altcoin’s bullish momentum.

The positive funding rate further supports this outlook, indicating that long positions are dominating short positions. This suggests that traders expect the price of SUI to continue rising, contributing to the overall bullish sentiment surrounding the coin.

The rising Open Interest and positive funding rate indicate that more capital is flowing into SUI, reinforcing its position in the market. As more traders take long positions, this momentum could propel the price even further, creating a positive feedback loop.

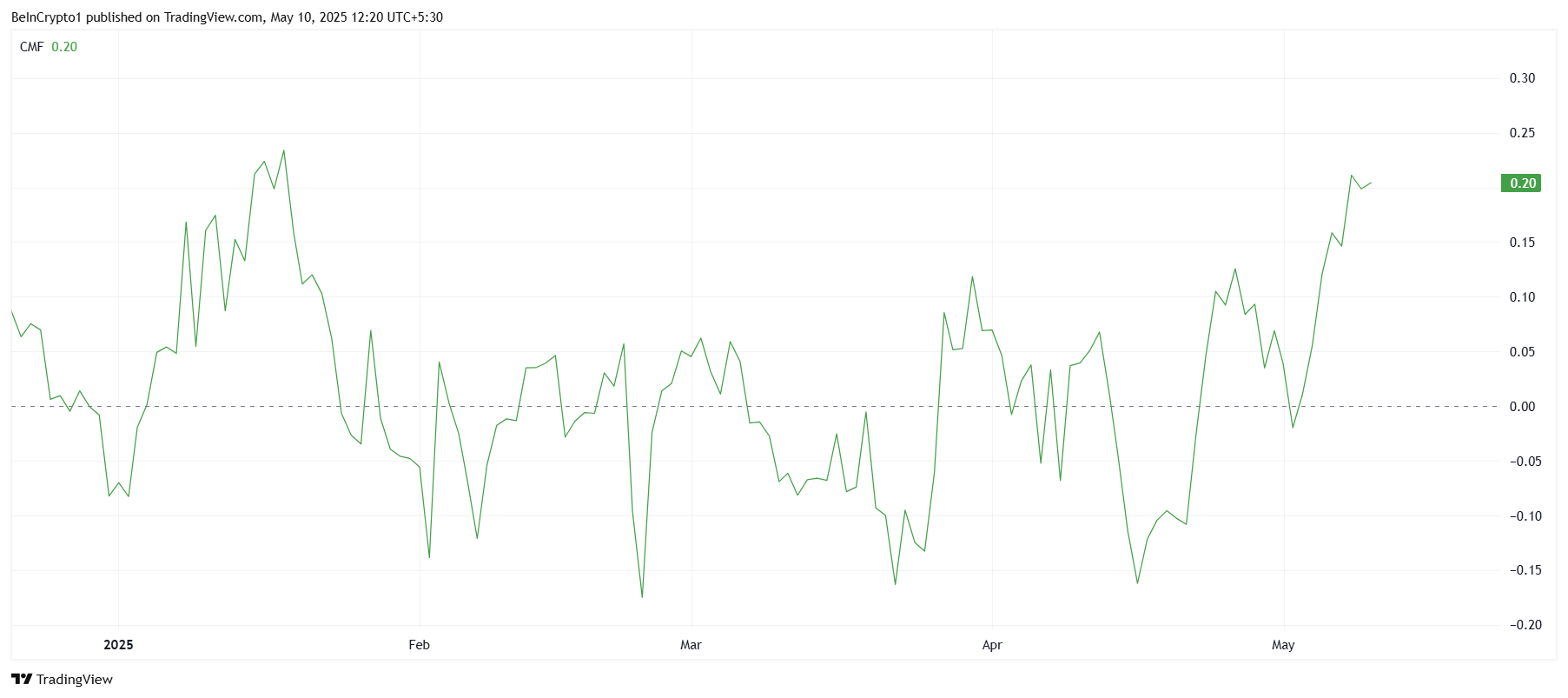

Technical indicators also support SUI’s overall macro momentum. The Chaikin Money Flow (CMF) is currently at a near four-month high, signaling that inflows are outweighing outflows.

This uptick suggests that investors are actively seeking to capitalize on the rising price of SUI, further driving demand.

As more capital enters the market, SUI’s upward momentum could continue, pushing its price higher. The increase in the CMF reflects the broader market’s positive sentiment and suggests that the altcoin’s rally is supported by strong investor confidence.

SUI Price Is Continuing Its Rise

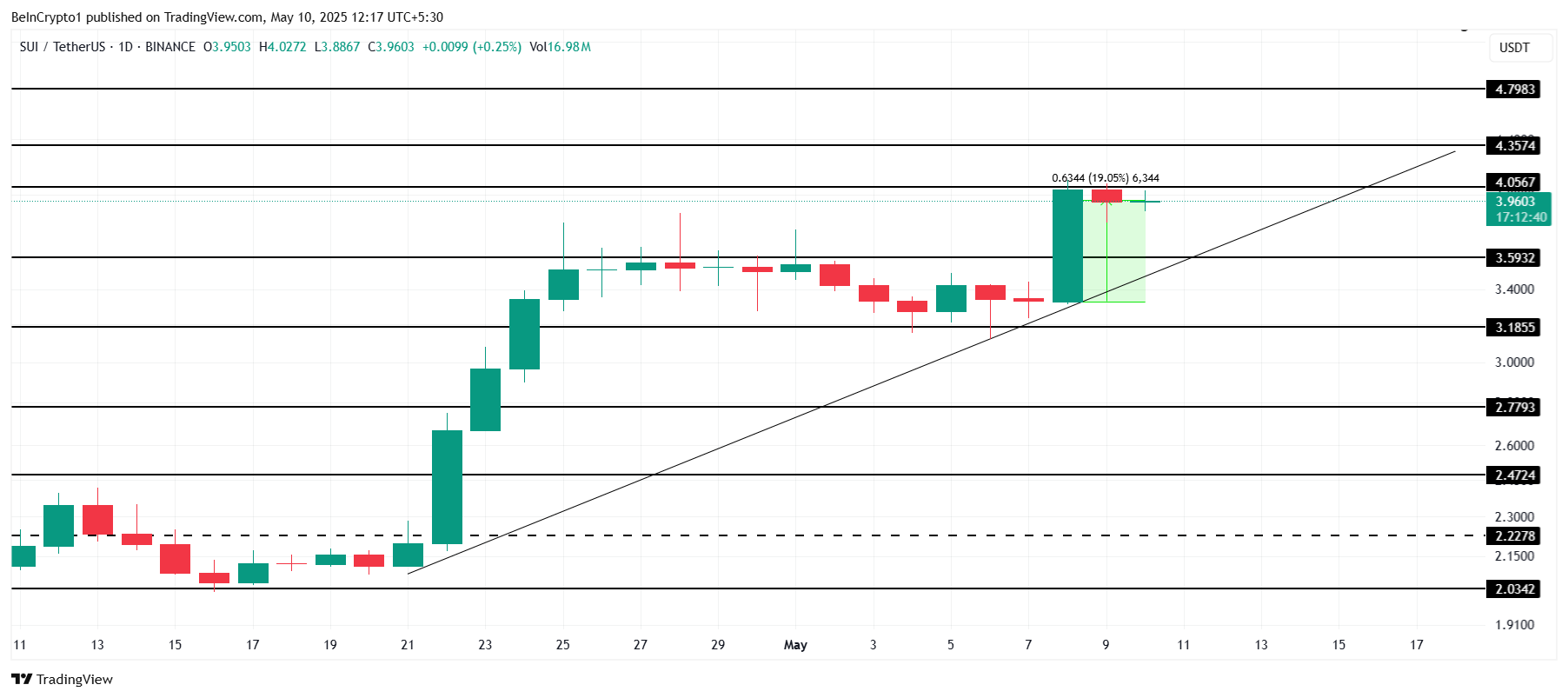

SUI’s price has risen by nearly 20% in the last 48 hours, trading at $3.96 at the time of writing. The altcoin is now approaching the key resistance level of $4.05.

Successfully breaching this barrier would help maintain the nearly three-week uptrend and could set the stage for further price gains. This level is crucial for the continuation of the rally.

If SUI manages to flip $4.05 into support, it would open the door to further upward movement. The next potential targets would be $4.79 or even higher, with $5.00 becoming a realistic possibility.

A sustained rally beyond this point would signal strong bullish sentiment and further price appreciation.

However, if SUI fails to breach $4.05 and experiences a reversal, it could drop to $3.59. Losing this support level would indicate a potential weakening of the bullish momentum, with the price potentially falling to $3.18.

If this happens, it would invalidate the current uptrend and shift the market sentiment towards a bearish outlook.

Comments

Post a Comment